On April 2, 2025, former U.S. President Donald Trump announced significant changes to U.S. trade policy, directly impacting global trade and particularly trading partners that impose high tariffs on U.S. goods. As part of a broader effort to address what the U.S. views as unfair trade practices, Trump’s tariffs introduced a 10% base tariff on all imported goods, effective April 5, 2025. Additionally, the U.S. unveiled a reciprocal tariff table for 180 countries, with some nations facing tariffs as high as 34% on their exports to the U.S.

This announcement represents a critical shift in Trump’s tariff policy, which aims to reshape the global trading system and address the trade deficits that have plagued the U.S. economy. The introduction of reciprocal tariffs will create a new dynamic in global trade, as foreign countries adjust their policies to cope with the rising costs imposed by U.S. tariffs. This marks a clear signal of America’s economic independence, as it attempts to impose tariffs to protect national interests and reduce trade barriers that have hindered U.S. industries.

In this article, we will break down the impact of these tariff hikes, explore how China and other key trading partners will be affected, and discuss potential strategies that businesses can use to mitigate the impact of the new tariffs, such as DDP shipping.

Understanding the New U.S. Tariff Policy and Its Global Impact

The April 2, 2025 tariff announcement marks a pivotal moment in U.S. trade policy under Trump’s administration. This shift, which is part of the administration’s efforts to reshape the global trading system, includes a 10% base tariff on all imports into the United States. In addition to this, the U.S. will impose reciprocal tariffs on countries that charge high tariffs on U.S. goods, creating a new dynamic for international trade.

Key Changes:

A base tariff of 10% on all imported goods, effective from April 5, 2025.

A 34% reciprocal tariff on Chinese imports, reflecting China’s high tariff on U.S. imports.

Higher tariffs on imports from countries like Vietnam, Taiwan, and other major trading partners.

The reciprocal tariff table includes 180 countries, each facing different tariff rates based on their trade practices with the U.S. Countries like China, Vietnam, and India are expected to see the most significant tariff increases due to the nature of their trade relationship with the U.S. This move is likely to create a ripple effect throughout the global economy, as nations adjust their strategies to cope with these increased costs.

How Will This Impact U.S. Imports from China?

The April 2, 2025 tariff hike introduces significant changes for U.S. imports, particularly those coming from China, the U.S.’s largest trading partner. As China faces a 34% reciprocal tariff, the cost of many Chinese imports—from electronics to clothing—will rise sharply, impacting both businesses and consumers in the U.S.

Electronics and Technology

China is one of the largest manufacturers of consumer electronics that are imported into the U.S. This includes smartphones, laptops, tablets, and other electronic devices. With the increased tariff, U.S. businesses will likely experience a price increase for these goods, which will be passed on to consumers. For example, a smartphone that previously cost $500 may now cost around $520 or more, depending on the total tariff impact. This could affect price-sensitive consumers, especially those purchasing multiple electronic devices or in bulk.

This situation is compounded by Trump’s tariffs, which aim to address the trade deficit and ensure that global trade is more balanced. The higher tariffs on Chinese electronics are expected to disrupt established supply chains, forcing companies to either raise prices or find new manufacturing partners in other countries that face lower tariffs.

Furniture and Home Goods

Another major category of Chinese imports is furniture and home goods. Products such as office chairs, sofas, and dining sets often come from China at relatively low prices. With the increased tariffs, these items will likely see a surge in cost, making them less affordable for U.S. consumers. Furniture retailers may face reduced margins or lower sales volumes, depending on how they choose to handle the increased costs. Consumers may delay purchases or seek cheaper alternatives, which could result in a slowdown in the furniture market.

As Trump’s tariff policy continues, furniture imports could shift away from China to countries like Vietnam or Mexico, where tariff rates are lower. This might cause some disruption in global supply chains but could provide an opportunity for businesses to diversify their sourcing strategies.

Toys and Other Consumer Goods

China is a dominant exporter of toys and everyday consumer goods, including kitchen appliances and personal care products. With the new tariffs, these products will become more expensive, which will likely affect retailers who rely on low-cost Chinese imports to maintain their competitive pricing. The increased tariffs could lead to higher retail prices for items such as children’s toys, kitchenware, and various other consumer goods. This would directly affect household budgets and might change consumer purchasing behavior.

Retailers will need to adjust their sales strategies and inventory management to account for these changes in purchasing behavior. Now that Chinese imports are facing a total tariff burden of up to 54%, it’s important to understand how these new tariffs are impacting different product categories. Below is a breakdown of the updated U.S. tariff rates on Chinese goods, effective April 9, 2025, following the Trump tariff announcement.

Updated Tariff Table: U.S. Import Duties on Chinese Goods (Effective April 2025)

Product Category | Original Tariff | New Reciprocal Tariff | Total Tariff Rate | Notes |

|---|---|---|---|---|

Consumer Electronics | 20% | +34% | 54% | Smartphones, laptops, tablets |

Furniture & Home Goods | 20% | +34% | 54% | Sofas, beds, desks |

Apparel & Footwear | 20% | +34% | 54% | All major textile and fashion categories |

Auto Parts | 20% | +34% | 54% | Tires, engine parts, and accessories |

Toys | 20% | +34% | 54% | Children’s and seasonal toys |

Small Kitchen Appliances | 20% | +34% | 54% | Cookers, kettles, blenders |

Lighting & Decor | 20% | +34% | 54% | Lamps, wall lights, chandeliers |

Machinery & Tools | 20% | +34% | 54% | Construction tools, mechanical parts |

Plastics & Packaging | 20% | +34% | 54% | Packaging materials and bulk plastics |

Fabrics & Raw Textiles | 20% | +34% | 54% | Yarn, cotton, and synthetic textiles |

Note: These tariff rates reflect reciprocal tariffs introduced in response to foreign tariff practices. As outlined in the Trump administration’s official announcement, the policy took effect on April 9, 2025.

These significant tariff increases are expected to raise the cost of consumer goods and auto parts, placing additional pressure on American consumers and supply chains. Businesses that continue to rely on Chinese imports may face difficult decisions on pricing, sourcing, and long-term trade planning. In the next section, we’ll explore how U.S. companies are adjusting to this new tariff environment.

How U.S. Businesses Are Adapting to Trump’s Tariff Hike

In response to the April 2025 tariff policy introduced by President Donald Trump, U.S. businesses are adjusting their logistics, sourcing, and pricing strategies to cope with the rise in reciprocal tariffs and higher import costs. These adjustments are essential to maintaining competitiveness amid rising operational expenses and a shifting global supply chain.

Diversifying Suppliers and Sourcing Locations

One of the most common strategies is supply chain diversification. Many businesses that previously relied heavily on Chinese imports are now sourcing products from countries with lower tariff rates, such as Vietnam, India, and Mexico. This approach, often referred to as the “China-plus-one” strategy, helps reduce dependence on a single country and spreads tariff exposure.

For example, electronics manufacturers that once assembled products entirely in China are now moving final assembly operations to Vietnam or Mexico to qualify for lower U.S. import tariffs. Apparel brands are increasing orders from Cambodia and Bangladesh, where tariff rates are significantly lower than those on Chinese-made goods.

Using DDP Shipping for Cost Clarity

Many importers are switching to Delivered Duty Paid (DDP) shipping, a logistics model where the foreign supplier handles all customs duties and import taxes before the goods arrive in the U.S. This method provides cost predictability, as businesses know the full landed price upfront.

DDP shipping also streamlines the customs clearance process and reduces delays, making it a popular option for companies trying to maintain delivery timelines and avoid compliance risks under the new tariff policy.

Adjusting Pricing Models and Product Strategies

With the rise in tariff rates, businesses are faced with the tough decision of either absorbing the higher costs or passing them on to consumers. Many adopt a hybrid model—absorbing tariffs on competitive or essential goods while increasing prices on premium or luxury items.

Some companies are even reducing their product lines, focusing only on items that remain profitable under the current tariff structure. Others are modifying product specifications slightly to reclassify them under tariff codes with lower duty rates—an approach known as tariff engineering.

Strengthening Trade Compliance

To adapt to the complex trade policy environment, businesses are investing in compliance audits, rechecking their HS codes, and training staff to ensure that all imports meet U.S. customs requirements. Companies are also leveraging tools like Foreign Trade Zones (FTZs) and duty drawback programs to reduce their overall tariff burden.

Increased enforcement means businesses must maintain accurate documentation of product origin and classification to avoid penalties or shipment delays. Many firms are hiring customs brokers or trade consultants to help navigate the evolving tariff landscape.

Case Examples by Industry

Apparel: Clothing retailers are shifting production to Vietnam and Central America. Basic items may absorb the tariff, while higher-end pieces see modest price increases.

Electronics: Companies are relocating assembly outside China and increasing reliance on Mexico or Taiwan. Product prices may rise modestly due to higher component costs.

Furniture: U.S. furniture retailers are rapidly expanding sourcing from Southeast Asia. Vietnam has become a dominant exporter, replacing China in many product categories.

Planning for Long-Term Trade Uncertainty

Beyond immediate adjustments, companies are building long-term plans that account for continued trade tensions and tariff unpredictability. This includes:

Running “what-if” simulations for future tariff increases

Establishing backup suppliers

Increasing inventory buffers

Delaying capital investments until trade policies stabilize

Trump’s tariffs have made trade policy a core consideration in supply chain planning. Companies that can remain agile and proactive in their response are most likely to weather this high-tariff era successfully.

Learn more:

How to Import and Ship Camping Gear from China

How to Source and Import A4 Paper from China

How to Import and Ship Lithium Batteries from China

Comprehensive Guide to DDP Shipping from China to the UAE

How Much Does Air Freight from China to Los Angeles Cost?

DDP Shipping from China to USA: Air & Sea Freight Cost and Delivery Time (2025 Guide)

How U.S. Consumers Are Affected by the Tariff Hike

The implementation of Trump’s new tariffs has created a ripple effect not just for businesses, but also for American consumers, who are beginning to feel the impact through higher costs on everyday items. As the U.S. enforces a 10% base tariff on all imported goods and additional reciprocal tariffs on countries like China, Vietnam, and others, the prices of many consumer goods are already on the rise.

Price Increases on Essential Products

Product categories such as electronics, clothing, home furnishings, and even auto parts are being directly affected by the new tariff rates. For instance:

Smartphones, laptops, and televisions imported from China are expected to become 5–15% more expensive, depending on the product.

Clothing items, especially from major Asian suppliers, are seeing gradual price hikes due to reciprocal tariffs.

Furniture—a category heavily dependent on Vietnamese and Chinese manufacturing—is now costing retailers more, leading to noticeable price jumps for sofas, beds, and office chairs.

Auto tariffs on parts imported from Asia are expected to increase the overall cost of vehicle repairs and maintenance in the U.S.

These increases are forcing American consumers to either delay non-essential purchases or seek cheaper alternatives, such as off-brand products or used goods.

Shifting Consumer Behavior and Spending Habits

With inflation already a concern in early 2025, the higher import tariffs are further straining household budgets. As the cost of imported goods rises, consumer spending is expected to slow, especially in discretionary sectors like home electronics, fashion, and decor.

Many households are now prioritizing essential spending, opting for durable goods with longer lifespans and switching to domestic brands to avoid tariff-related price increases. This shift in purchasing habits is likely to affect retail sales in Q2 and Q3, particularly for mid-range and luxury items.

Large retailers such as Walmart and Target have already announced slight price increases in select product categories, citing the new tariffs and logistical challenges caused by global supply chain disruptions. Smaller retailers, with less margin to absorb tariff-related costs, may struggle even more to remain competitive.

Broader Economic Implications

Beyond household spending, the tariff hike may have a broader impact on the global economy. As American consumers spend less on imported goods, demand for foreign products could drop, affecting trade balances and production rates in manufacturing-heavy countries like China and Vietnam.

In the U.S., the combination of higher costs, constrained supply chains, and changing consumer behavior may also influence economic growth. Analysts predict that if tariff rates remain elevated through the remainder of 2025, we could see extended pressure on consumer sentiment and retail-driven sectors.

Moreover, certain seasonal events—like back-to-school shopping and the holiday retail season—could be notably impacted, as consumers may reduce spending or shift to buying fewer, more essential items.

The Long-Term Impact on the Global Economy and U.S. Trade Policy

As the dust settles from the Trump tariff announcement on April 2, 2025, businesses and governments alike are now preparing for the long-term effects. While the immediate economic reaction focused on rising prices and disrupted supply chains, the broader impact on global trade, U.S. policy, and international relationships may reshape the trade landscape for years to come.

A Major Blow to Free Trade and Global Integration

The introduction of across-the-board reciprocal tariffs and targeted hikes on high-tariff countries like China, Vietnam, and Sri Lanka marks a departure from decades of globalization and free trade agreements. Critics argue that the Trump administration’s approach has dealt a major blow to the post-WWII free trade order.

By placing auto tariffs, electronics duties, and broad tariff rates on common imports, the U.S. is signaling a shift away from reliance on multilateral trade systems. As a result, countries may begin favoring bilateral or regional trade agreements, eroding the authority of organizations like the WTO and reshaping how global trade operates.

Triggering a Renewed Global Trade War?

Several major economies are already weighing retaliatory actions. If nations respond with counter-tariffs or unilateral tariff measures, this could spiral into a renewed trade war—one that impacts not just U.S.-China relations but also Europe, Southeast Asia, and Latin America.

In this climate, trade negotiations become more volatile, with countries less likely to compromise amid rising nationalism and political pressure. Businesses will be forced to operate in an environment where tariff policy is constantly shifting and where trade barriers can be introduced or removed almost overnight.

This uncertainty not only increases operational risk but also discourages long-term investment, particularly in sectors like manufacturing, automotive, and advanced technology, where global sourcing is key.

Strain on the Global Economy

Beyond the U.S., the global economy is likely to face ripple effects from these changes. Export-driven nations like China, Taiwan, and Vietnam may suffer production slowdowns, while developing countries dependent on U.S. markets could lose competitiveness due to higher tariff rates.

Meanwhile, American consumers will feel the impact through persistent higher costs on everyday products. The cumulative effect of reduced purchasing power and strained global production may lead to slower GDP growth, both domestically and abroad.

Analysts warn that if protectionist trends continue, we may see a fragmentation of the global trading system, with companies forced to regionalize supply chains, governments prioritizing economic independence, and consumers absorbing the financial burden.

The Future of U.S. Trade Policy

Looking ahead, the future of U.S. trade policy remains uncertain. While some experts believe the Trump administration’s move is a temporary negotiation tool, others see it as the new norm—where tariffs are used as strategic levers in both economic and diplomatic arenas.

Whether the current policy evolves into a more stable long-term framework or escalates into lasting global tension will depend on upcoming trade negotiations, election cycles, and how effectively businesses and governments adapt to the new rules of trade.

Regardless, one thing is clear: the 2025 tariff shift marks a turning point in U.S. trade history. Businesses that act now—diversifying suppliers, reinforcing compliance, and preparing for more volatility—will be best positioned to succeed in this new era.

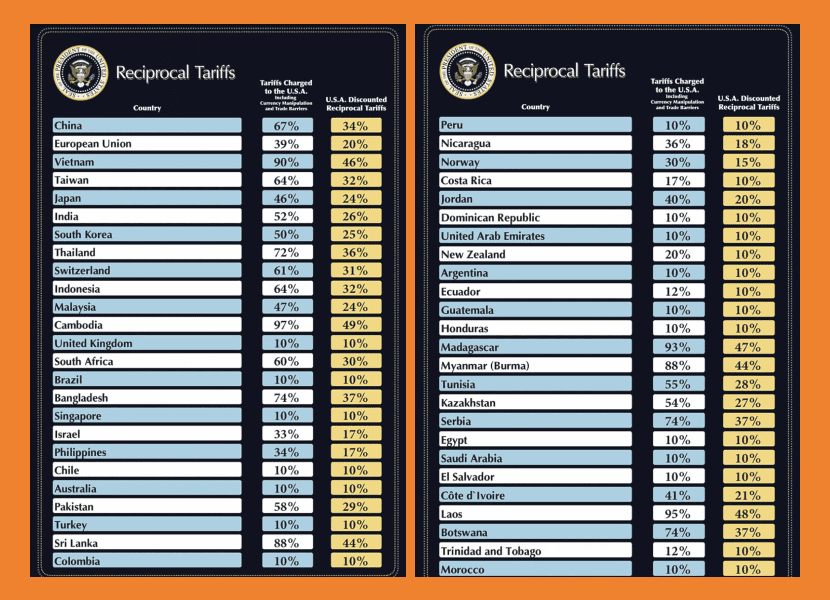

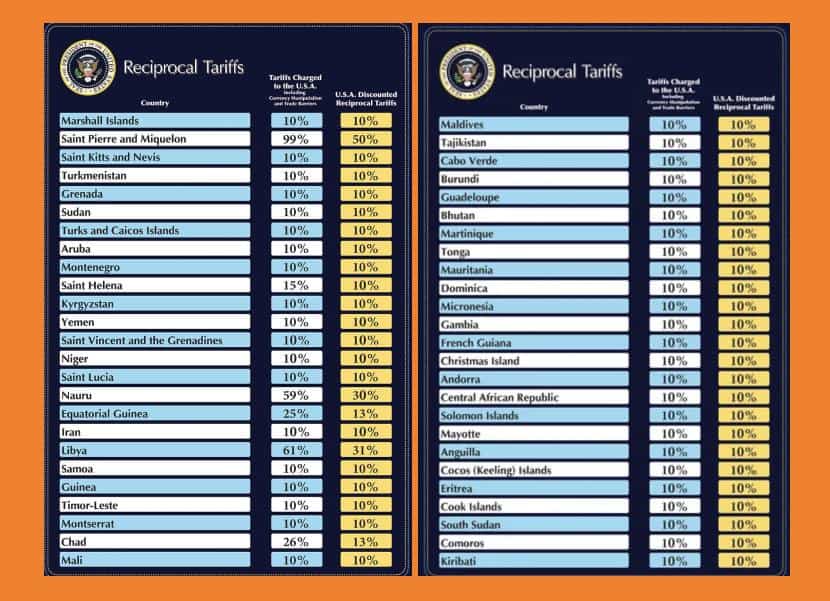

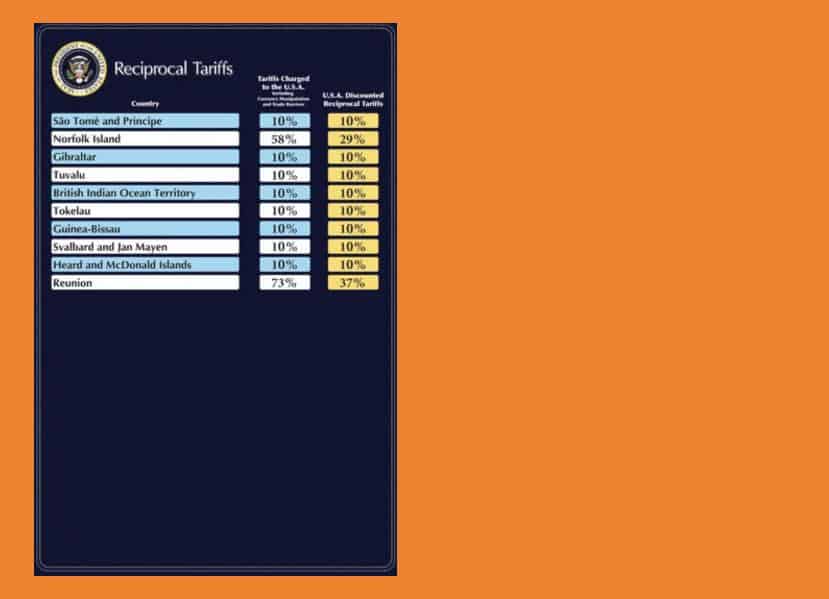

Full Tariff Chart – 180 Countries Affected by Trump’s Reciprocal Tariff Plan

As part of the April 2, 2025 Trump tariff announcement, the U.S. government released a detailed breakdown of reciprocal tariffs applied to over 180 countries. These measures reflect the principle of equal treatment — where countries that impose tariffs on U.S. exports will face similar or proportional import duties from the U.S.

The following charts, publicly released by the Trump administration, show the comparative tariff levels:

U.S. Tariff Levels on Major Economies (China, EU, Vietnam)

Reciprocal Tariffs on Asian and African Countries

Tariff Impact on Smaller Countries (Maldives, Tuvalu, Angola)

Frequently Asked Questions (FAQs)

What are reciprocal tariffs and how do they work?

Reciprocal tariffs are trade measures imposed by the U.S. in response to high tariffs from other countries. Under the new tariffs announced by the Trump administration, the U.S. applies tariffs proportional to what other nations charge on American exports. This policy aims to create a fairer global trading system.

When was the Trump tariff announcement made?

The Trump tariff announcement was officially made on April 2, 2025, and the tariffs took effect on April 5. These measures are part of a broader strategy to reassert economic independence and reduce reliance on foreign manufacturing.

How are American consumers affected by the new tariffs?

American consumers will face higher costs on a wide range of consumer goods, including electronics, furniture, clothing, and auto parts. These price increases may influence buying habits and increase inflationary pressure across the country.

Which industries are hit hardest by the tariff rates?

Industries such as automotive, retail, and electronics are among the most heavily affected. Due to rising auto tariffs and tariff rates on Chinese imports, many companies are adjusting their pricing and sourcing strategies to stay competitive.

What is the role of the U.S. Trade Representative?

The U.S. Trade Representative (USTR) is responsible for implementing trade policies, including these new tariffs, negotiating with foreign governments, and responding to trade tensions or retaliatory measures from other countries.