Importing goods from China can be highly profitable—but only when you understand the necessary documents and import requirements. Whether you’re a first-time importer or a seasoned buyer, having the correct paperwork ensures faster customs clearance, reduces delays, and keeps your business compliant with both Chinese regulatory requirements and your local authorities.

China is often called “the factory of the world” due to its robust manufacturing sector, extensive supply chain, and competitive pricing. As global sourcing continues to rise, understanding the shipping process and documentation becomes essential.

This 2025 guide breaks down all the standard documents required to import from China with practical explanations and examples. From commercial invoices to specialized certificates, you’ll learn how to prepare correct documentation, avoid penalties, and streamline your international trade operations.

Commercial Invoice for Importing Goods from China

A commercial invoice is one of the most necessary documents required when importing goods from China. It acts as an official invoice issued by the supplier and serves as both a request for payment and a declaration of transaction details.

It typically includes:

Name and address of the seller and buyer

Description and quantity of the goods

Unit price and total purchase price

Currency used

Customs authorities rely on this invoice to assess import taxes and duties. It must align with other documents such as the packing list and bill of lading to ensure correct documentation.

In most cases, Chinese suppliers will provide a pro forma invoice first, followed by the final commercial invoice after order confirmation. A 30/70 payment structure is common, with 30% paid upfront and 70% due before shipment. The commercial invoice also plays a vital role in record keeping and in formalizing the sales contract between buyer and seller

Packing List for Cargo Transport & Customs Clearance

A packing list is a vital document for cargo transport, customs verification, and warehouse processing. It provides a detailed breakdown of the physical contents of the shipment, which helps freight forwarders, shipping companies, and customs agents handle your goods properly.A standard packing list includes:

Shipper and consignee information

Description of goods

Quantity, weight, and dimensions

Number and type of packages (e.g., cartons, pallets)

Marks and package numbers

While it does not contain prices like a commercial invoice, the packing list plays a crucial role in ensuring a smooth shipping process. When using a full container load (FCL), accurate details help avoid miscounts or delays when the goods arrive at the destination.

Importers dealing with chinese products regularly must ensure the packing list matches the invoice and other documents. This is essential for record keeping and helps maintain transparency during the customs inspection process.

Bill of Lading or Air Waybill Explained for Importing Products

Depending on your chosen mode of transport, you’ll receive either a bill of lading (B/L) for sea freight or an air waybill (AWB) for air shipments. These documents are essential for importing products, confirming shipment details, and completing customs clearance procedures.

Bill of Lading (B/L)

A bill of lading serves as a contract between the shipper and the shipping carrier, and as proof of ownership of the goods. It must be presented at the destination port to release the shipment. Key elements include:

Container number

Port of origin and destination

Product description and quantity

Name of freight forwarder, shipping line, and agent

Shipping terms (e.g., prepaid, collect, FOB, CIF)

There are two main types of B/L:

Original Bill of Lading: Physical copy needed to release goods

Telex Release: Digital version, faster and often preferred

Once the goods arrive, the consignee or customs broker presents the appropriate documents to claim the cargo. In some cases, chinese customs agents may be involved to verify documents prior to release.

Air Waybill (AWB)

For air freight, the air waybill acts as a non-negotiable transport document and receipt of goods. It includes:

Airline and tracking number

Consignor and consignee details

Weight, description, and dimensions of the goods

Flight routing and charges

An arrival notice is usually issued by the airline or agent to notify the buyer that goods are ready for pickup. While it doesn’t transfer ownership, the AWB is key for coordinating final delivery.Full Container Load (FCL) vs Less Than Container Load (LCL)

When shipping from China, you’ll often choose between Full Container Load (FCL) and Less Than Container Load (LCL). FCL means the entire container is reserved for your shipment—ideal for large volumes, better protection, and more control over the shipping process. LCL is better for smaller shipments, where goods are consolidated with others. While it’s cost-effective, LCL may lead to longer transit times or increased handling risk. Selecting the right option depends on cargo volume, urgency, and your overall final costs. Your shipping carrier or freight agent can advise based on your needs.

When Is an Import License Required?

An import license is not always needed when importing goods from China. However, certain categories of regulated products are subject to strict import requirements and must be approved by national authorities before entry. These requirements are typically tied to product safety, health, or environmental concerns.

Common product categories that require an import license include:

Pharmaceuticals and medical devices

Chemicals and hazardous materials

Agricultural goods (e.g., grains, seeds, meats)

Electronics and wireless communication equipment

Food and beverages, especially items subject to food safety laws

Depending on your country, you may also need approval from partner government agencies such as:

FDA, FCC, USDA (United States)

CE conformity bodies (European Union)

The Agricultural Affairs Office (varies by region)

If your shipment lacks the required license or registration requirements, it may be delayed, seized, or destroyed by border protection authorities. The importer of record is fully responsible for compliance and should verify licensing obligations before ordering.

In some cases, a freight forwarder or customs broker can help determine whether your goods fall under license control and assist in submitting the appropriate documentation

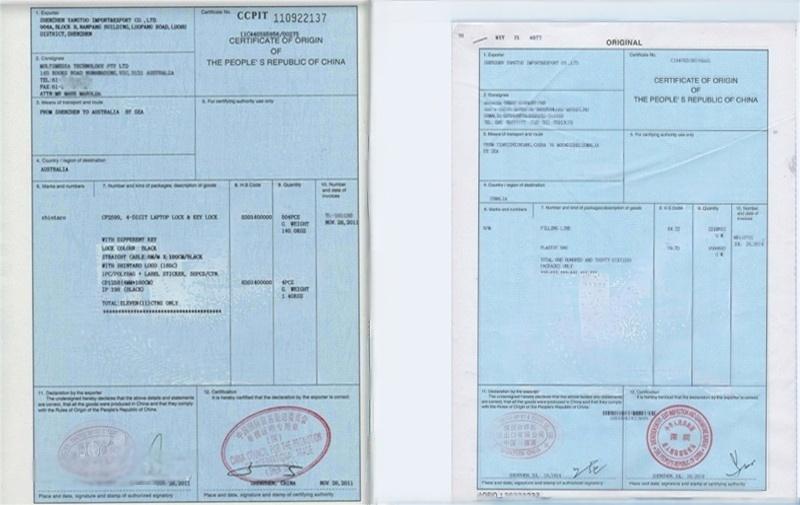

Certificate of Origin for Branded Products and Duty Reduction

A Certificate of Origin (COO) is an official trade document that verifies the country of manufacture—China in this case. It is commonly issued by chambers of commerce or accredited trading companies, and helps determine eligibility for tariff benefits under Free Trade Agreements.

Presenting a COO can significantly reduce import duties, especially when branded products or finished goods are involved. Some of the most widely used origin certificates include:

Form E: For ASEAN countries under the China–ASEAN FTA

Form A: For countries under the Generalized System of Preferences (GSP)

RCEP Certificate: For member countries in the Regional Comprehensive Economic Partnership

In many jurisdictions, electronic versions (e-CO) are accepted, but others may still require a physical origin bill. To avoid confusion, always check which version is recognized by your destination customs authority.

Your COO should align exactly with your commercial invoice and customs declaration. Discrepancies can trigger audits or even rejection at customs.

For businesses operating in competitive commodities markets, using accurate COO documents helps reduce final costs and ensures smoother clearance processes

Customs Declaration: How to Ensure Proper Documentation

A customs declaration is a required document for clearing goods through the border. It informs customs authorities about your shipment’s contents, value, and compliance with import regulations. Failing to submit accurate details may result in penalties, delays, or even seizure of cargo.

A typical customs declaration package includes:

Importer’s business license or registration requirements

Commercial invoice and packing list

Bill of lading or air waybill

Product HS codes and descriptions

Declared customs value and shipping terms

For high-value or controlled items, your country may also require a customs bond. This serves as a financial guarantee that duties and taxes will be paid.

In most countries, a licensed customs broker handles declaration submissions and liaises with partner government agencies such as border inspection offices, health departments, or agriculture regulators.

When importing through chinese customs agents, make sure they provide complete and consistent documentation to avoid clearance issues. Maintaining correct documentation and organized record keeping are critical for audit trails and future shipments.Do You Need a Customs Bond? Here’s When and Why

A customs bond is a financial guarantee required by some countries—such as the United States—when you’re importing goods above a certain value or items that are subject to government regulations. The bond ensures that duties, taxes, and penalties will be paid, even if the importer fails to do so. It’s especially relevant for new businesses or those dealing in controlled goods like chemicals, electronics, or branded products. Not having the appropriate customs bond in place can delay clearance and trigger fines. Your customs broker or freight forwarder can help determine if your shipment requires one.

HS Code Classification and Import Taxes Breakdown

Every item you import from China must be assigned a correct HS (Harmonized System) Code, which classifies the goods internationally. This code is essential for determining import taxes, VAT, and whether any restrictions apply.

Why is the HS Code important?

It identifies the product category with globally standardized product details

It determines whether the product needs specialized documents or licenses

It helps customs apply accurate tariffs and ensure fast customs clearance

For example, HS Code 850110 is used for “electric motors under 37.5W.” Misclassifying your goods could lead to underpayment or overpayment of taxes, or even customs penalties.

Most freight forwarders or customs brokers can help you find the right code. The HS Code must appear consistently on your commercial invoice, packing list, and customs declaration as part of your standard documents.

Ensuring proper classification is also crucial for compliant record keeping, especially in highly regulated sectors like electronics, chemicals, and health foods. Using the wrong HS code is one of the most common causes of customs delays

Additional Certificates and Specialized Documents for Food Safety

Depending on the nature of your products, additional specialized documents may be required to meet regulatory requirements in the destination country. These certificates verify product compliance with quality supervision, environmental, or food safety standards.

Common types of certificates include:

CE Certificate – For electronics and machinery exported to the EU

MSDS (Material Safety Data Sheet) – For chemicals, batteries, or hazardous items

Fumigation Certificate – Required for wooden packaging or pallets

Test Reports and Quality Licenses – Often needed for health foods, toys, or medical products

Insurance Certificate – For high-value or fragile goods

Inspection Certificate – Issued by CIQ (China Inspection and Quarantine) authorities

Importers of food products or supplements should confirm all relevant food regulation compliance through lab testing and origin certification. This is especially important when importing to the EU or USA.

It’s also wise to request product samples before mass production to verify labeling and quality control. In many cases, working with a reliable freight forwarder can ensure that all required paperwork is submitted on time and without errors

Pro Forma Invoice vs Purchase Order: What Chinese Suppliers Expect

Before issuing an official invoice, most transactions with Chinese suppliers begin with a pro forma invoice (PI) or a purchase order (PO). These two standard documents form the foundation of your trade agreement and help establish trust between buyer and seller.

Pro Forma Invoice (PI)

A PI is a preliminary quote sent by the seller and typically includes:

Product name, specifications, and product price

Quantity and shipping method

Estimated total cost

Delivery terms and shipping terms

This document is often used when applying for an import license or confirming trade terms. It can also assist in estimating final costs and preparing internal approvals.

Purchase Order (PO)

A PO is a buyer-issued document that acts as a formal request to purchase. It often functions as a legal sales contract, containing:

Agreed quantities and specs

Payment conditions

Delivery schedule

In many cases, trading companies and Chinese factories will request both documents for internal record keeping and as part of the procurement process. While these documents are not required for customs, they’re vital for consistency, audits, and financial tracking.

Remember: documents vary depending on your destination country and product type—what works for electronics may differ from that for restaurant sector food items.How to Work with Chinese Suppliers for Better Results

Building a strong relationship with reliable Chinese suppliers is crucial for successful importing. Before placing large orders, always ask for product samples and perform thorough quality control checks. Clearly define specifications in the sales contract, including packaging, materials, and delivery timeframes. Many importers also arrange factory audits or third-party inspections—especially when dealing with chinese factories producing food, electronics, or textiles. Regular communication, transparency, and using well-defined documents can prevent misunderstandings and ensure your goods meet expectations.

CIQ Inspection Certificates and Registration Requirements

In some cases, imported goods must pass inspection by Chinese regulators before they are allowed to leave the country. The China Inspection and Quarantine (CIQ) authority issues inspection-related documents to verify product compliance with safety, hygiene, and technical standards.

A commodity inspection certificate is typically required for:

Food and agricultural products

Medical devices and pharmaceuticals

Toys, textiles, and baby products

Machinery and electrical equipment

These certificates confirm that products meet national and international safety criteria and are often required when importing to countries with strict quality supervision policies.

Additional certificates such as quality licenses may be requested by buyers or border officials, especially when dealing with regulated or high-risk goods. Products that fall under CIQ’s mandatory inspection list must be cleared before they can be loaded for export.

Many importers rely on freight forwarders or Chinese trading companies to manage this documentation. It’s also important to verify if your goods are subject to pre-shipment registration requirements or inspections coordinated by partner government agencies in your destination country.

Missing inspection paperwork may result in delays, rejections, or customs holds—especially in sensitive sectors like food regulation or consumer health. Always double-check with your supplier and agent for updated documentation rules.

Frequently Asked Questions (FAQ) About Importing from China

What is the most important document when importing from China?

The commercial invoice is essential. It determines the customs value of your shipment and must match all other standard documents for smooth customs clearance.

Do I need an import license for every product?

No. However, certain products—especially chemicals, health foods, and electronics—may require an import license or additional permits from partner government agencies.

What if my goods require pre-approval or inspection?

Some products must go through CIQ inspections in China. In these cases, an inspection certificate or quality licenses are needed before loading. Check whether your item is listed by chinese regulators or requires registration abroad.

Can I import without a customs broker?

While it’s possible, working with a licensed customs brokerage or freight forwarder helps avoid errors in classification, HS code selection, and correct documentation—especially if you’re unfamiliar with your country’s import laws.

How can I reduce risks and improve profit margins?

Start by requesting product samples to assess quality. Choose Incoterms wisely (like FOB or DDP) for more control over the shipping process and costs. Transparent pricing and a clear sales contract help you calculate your final costs and protect your profit margins.

What if I’m importing food items for the restaurant sector?

You may need to meet food regulation standards and declare food preferences (e.g., organic, halal). Always coordinate with customs agents or food safety authorities in your country to avoid rejection.

What if my import documents are incomplete or mismatched?

If your standard documents—like invoices, packing lists, and certificates—have inconsistent details (e.g., mismatched quantities or product names), customs officials may delay or even reject your shipment. This is especially risky in commodities markets where scrutiny is high. Work with a customs brokerage to ensure your necessary documents are 100% aligned.

What is the role of a shipping carrier in the documentation process?

A reliable shipping carrier helps ensure your documents flow through the right channels—from port of loading to final customs clearance. They may also coordinate with your shipping company, forwarder, and warehouse. Selecting the right partner is especially important when dealing with full container load (FCL) shipments or large product catalogs.

Do documents change based on product category or destination?

Yes—documents vary significantly based on what you’re shipping and where. For example, exporting to the EU may require CE certification and language labeling, while food items heading to the restaurant sector may require info on food preferences and origin. Always check local import laws and confirm requirements with your supplier.

Final Thoughts and Import Checklist

Importing from China can be highly rewarding—but success depends on proper preparation and complete documentation. From your initial purchase order to final customs clearance, every step must be accurate, timely, and well-documented.

Here’s a quick checklist to help you avoid common pitfalls:

Confirm supplier credentials and request product samples

Ensure your sales contract, pro forma invoice, and commercial invoice are aligned

Match all information across documents (quantities, descriptions, prices)

Classify your goods using the correct HS code

Prepare for customs bond, inspection certificates, or import licenses if needed

Use a trusted freight forwarder or customs broker to handle the process

Whether you’re importing branded products, health foods, or electronics, good planning reduces cost, prevents delays, and increases your long-term profitability.